41+ can i deduct mortgage insurance premiums

Theyre reported on line 13 of Schedule A Interest You Paid. ITA Home This interview will help.

Is Mortgage Insurance Tax Deductible Bankrate

However the insurance contract must have been.

. The deduction for certain mortgage insurance premiums has. Web You can deduct this entire amount. Web Can I deduct private mortgage insurance PMI or MIP.

The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. If you are claiming itemized. Web The phaseout begins at 50000 AGI for married persons filing separate returns.

The PMI deduction is reduced by 10 percent for each 1000 a filers income. Be aware of the phaseout limits however. Mortgage insurance premiums are itemized tax deductions.

Web Eligible W-2 employees need to itemize to deduct work expenses. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

SOLVED by TurboTax 5841 Updated January 13 2023. Whether you qualify depends on both your filing status and. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you decide.

Web Deduction for mortgage insurance premiums as qualified residence interest under Section 102 of the Act. The PMI tax deduction works for home purchases and for refinances. Web If you have an FHA loan you may be able to deduct your mortgage insurance premium if your loan originated after December 31 2017 and your annual.

Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP. The itemized deduction for mortgage. Web That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of.

Web You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage. Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses. Web No longer deductible in 2022.

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

Mortgage Insurance Paid Upfront The New York Times

Private Mortgage Insurance How Pmi Works Cnet Money

5 Types Of Private Mortgage Insurance Pmi

Is Pmi Tax Deductible Credit Karma

Can I Deduct Mortgage Insurance Premiums From Rental Property Sapling

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc

What Is Pmi Understanding Private Mortgage Insurance

6 Insurance Quote Templates Pdf

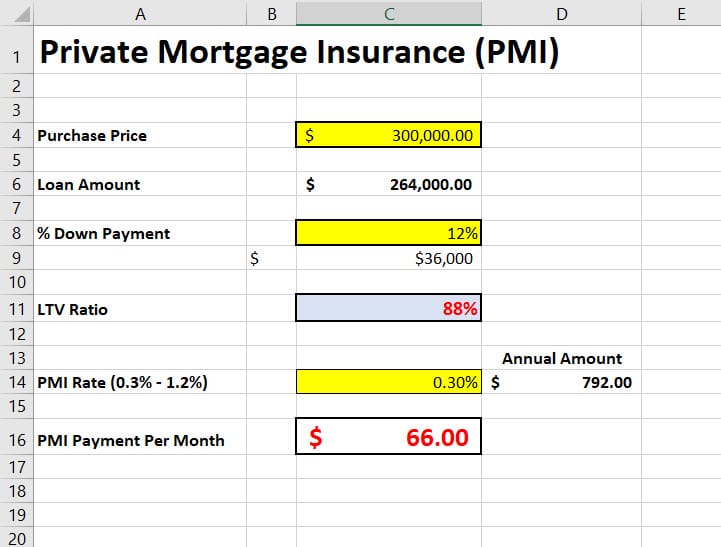

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

How To Get Cheaper Homeowner S Insurance 9 Must Try Strategies

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Can I Deduct Mortgage Insurance Premiums From Rental Property Sapling

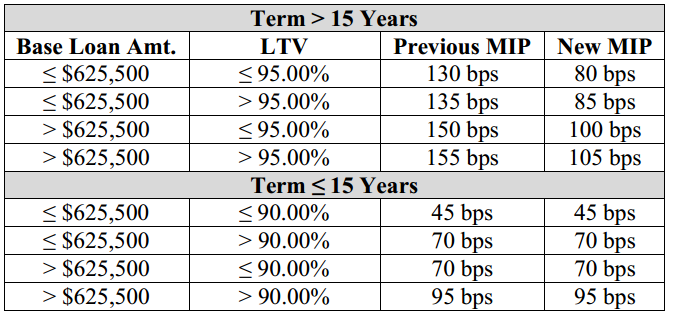

Fha Slashes Mortgage Insurance Premium How Much Will You Save California Mortgage Broker

Pay Attention To The Extra Costs

Mortgage Insurance Premiums Are Still Deductible For The 2017 Tax Year Mortgage Rates Mortgage News And Strategy The Mortgage Reports